Conditional Selections

|

Conditional Selections |

The Select...Case Statement

Introduction

If you have a large number of conditions to examine, the If...Then...Else statement will go through each one of them. The Visual Basic language offers the alternative of jumping to the statement that applies to the stated condition. This is done with the Select Case operator.

The formula of the Select Case statement is:

Select Case expression Case expression1 statement1 Case expression2 statement2 Case expressionX statementX End Select

The statement starts with Select Case and ends with End Select. On the right side of Select Case, enter a value or an expression that will be checked.

Boolean Case Selections

The value of expression can be a Boolean value. In this case, one case would be True and the other would be False.

The expression can produce a character or a string (a String type). In this case, each Case would deal with a value in double-quotes.

Finding a Character or a Sub-String in a String

The expression can be a natural number from a Byte, an Integer, or a Long type.

Practical

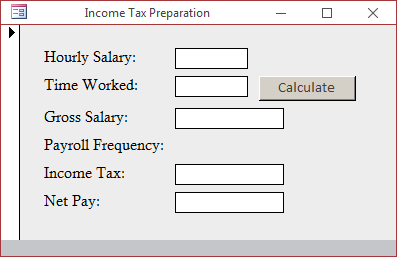

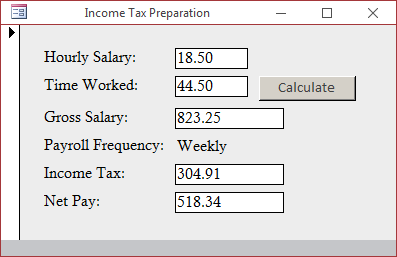

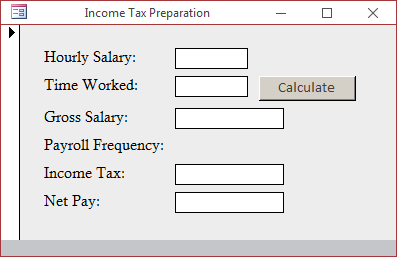

Learning: Introducing Case Selection

Practical

Learning: Introducing Case Selection

Private Sub cmdCalculate_Click()

Dim incomeTax As Double

Dim hourlySalary As Double, timeWorked As Double

Dim grossSalary As Double, netPay As Double

Dim payrollFrequency As Integer

hourlySalary = CDbl(Nz(txtHourlySalary))

timeWorked = CDbl(Nz(txtTimeWorked))

grossSalary = hourlySalary * timeWorked

payrollFrequency = CInt(InputBox("Enter a number for the frequency by which " & vbCrLf & _

"the payroll is processed:" & vbCrLf & _

"1 - Weekly" & vbCrLf & _

"2 - Biweekly" & vbCrLf & _

"3 - Semimonthly" & vbCrLf & _

"4 - Monthly", _

"Payroll Frequency", "1"))

If (payrollFrequency < 1) Or (payrollFrequency > 4) Then payrollFrequency = 1

Select Case payrollFrequency

Case 1

incomeTax = 99.1 + (grossSalary * 0.25)

Case 2

incomeTax = 35.5 + (grossSalary * 0.15)

Case 3

incomeTax = 38.4 + (grossSalary * 0.15)

Case 4

incomeTax = 76.8 + (grossSalary * 0.15)

End Select

netPay = grossSalary - incomeTax

TxtHourlySalary = TxtHourlySalary

txtTimeWorked = txtTimeWorked

txtGrossSalary = FormatNumber(grossSalary)

Select Case payrollFrequency

Case 1

txtPayrollFrequency = "Weekly"

Case 2

txtPayrollFrequency = "Biweekly"

Case 3

txtPayrollFrequency = "Semimonthly"

Case 4

txtPayrollFrequency = "Monthly"

End Select

txtIncomeTax = FormatNumber(incomeTax)

txtNetPay = FormatNumber(netPay)

End Sub

An Enumerated Case Selection

The expression can be an enumeration. In this case, the expression would be the name of the enumeration. Each Case would deal with one of the members of the enumeration.

The Character Cases of a String

What Case Else?

If you anticipate that there could be no match between the expression and one of the values in the cases, you can use a Case Else statement at the end of the list. The statement would then look like this:

Select Case expression

Case expression1

statement1

Case expression2

statement2

. . .

Case expression-n

statement-n

Case Else

statement-else

End Select

In this case, the statement after the Case Else will execute if none of the values of the cases matches the expression.

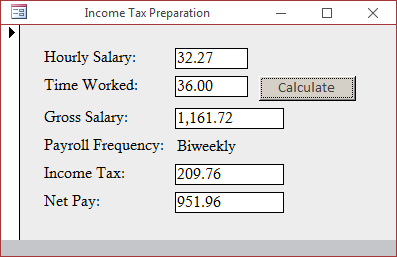

Practical

Learning: Introducing Case Selection

Practical

Learning: Introducing Case Selection

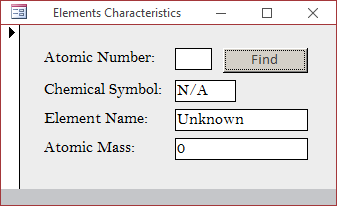

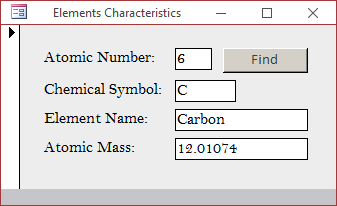

Private Sub cmdFind_Click()

Dim chemicalSymbol As String

Dim atomicNumber As Integer

Dim elementName As String

Dim atomicMass As Single

atomicNumber = CInt(Nz(txtAtomicNumber))

Select Case atomicNumber

Case 1

chemicalSymbol = "H"

elementName = "Hydrogen"

atomicMass = 1.0079

Case 2

chemicalSymbol = "He"

elementName = "Helium"

atomicMass = 4.002682

Case 3

chemicalSymbol = "Li"

elementName = "Lithium"

atomicMass = 6.941

Case 4

chemicalSymbol = "Be"

elementName = "Berylium"

atomicMass = 9.0122

Case 5

chemicalSymbol = "B"

elementName = "Boron"

atomicMass = 10.811

Case 6

chemicalSymbol = "C"

elementName = "Carbon"

atomicMass = "12.01074"

Case Else

chemicalSymbol = "N/A"

elementName = "Unknown"

atomicMass = 0#

End Select

txtChemicalSymbol = CStr(chemicalSymbol)

txtElementName = CStr(elementName)

txtAtomicMass = CStr(atomicMass)

End Sub

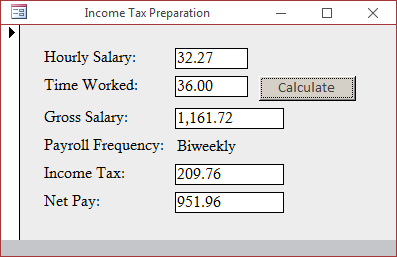

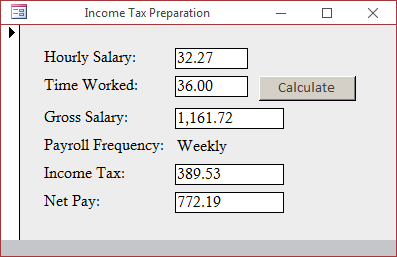

Private Sub cmdCalculate_Click()

Dim incomeTax As Double

Dim hourlySalary As Double, timeWorked As Double

Dim grossSalary As Double, netPay As Double

Dim payrollFrequency As Integer

hourlySalary = CDbl(Nz(TxtHourlySalary))

timeWorked = CDbl(Nz(txtTimeWorked))

grossSalary = hourlySalary * timeWorked

payrollFrequency = CInt(InputBox("Enter a number for the frequency by which " & vbCrLf & _

"the payroll is processed:" & vbCrLf & _

"1 - Weekly" & vbCrLf & _

"2 - Biweekly" & vbCrLf & _

"3 - Semimonthly" & vbCrLf & _

"4 - Monthly", _

"Payroll Frequency", "1"))

If (payrollFrequency < 1) Or (payrollFrequency > 4) Then payrollFrequency = 1

Select Case payrollFrequency

Case 1

incomeTax = 35.5 + (grossSalary * 0.15)

Case 2

incomeTax = 38.4 + (grossSalary * 0.15)

Case 3

incomeTax = 76.8 + (grossSalary * 0.15)

Case Else

incomeTax = 99.1 + (grossSalary * 0.25)

End Select

netPay = grossSalary - incomeTax

TxtHourlySalary = TxtHourlySalary

txtTimeWorked = txtTimeWorked

txtGrossSalary = FormatNumber(grossSalary)

Select Case payrollFrequency

Case 1

txtPayrollFrequency = "Biweekly"

Case 2

txtPayrollFrequency = "Semimonthly"

Case 3

txtPayrollFrequency = "Monthly"

Case Else

txtPayrollFrequency = "Weekly"

End Select

txtIncomeTax = FormatNumber(incomeTax)

txtNetPay = FormatNumber(netPay)

End Sub

Combining Cases

When creating a Select Case situation, you may end up using two or more cases that proceed to the same outcome. Here is an example:

Private Sub cmdFunction_Click()

Dim Gender As String

Gender = "f"

Select Case Gender

Case "f"

MsgBox("Female")

Case "female"

MsgBox("Female")

Case "m"

MsgBox("Male")

Case "male"

MsgBox("Male")

Case Else

MsgBox("Unknown")

End Select

End Sub

Instead of using one value for a case, you can apply more than one. To do this, on the right side of the Case keyword, you can separate the expressions with commas. Here are examples:

Private Sub cmdFunction_Click()

Dim Gender As String

Gender = "F"

Select Case Gender

Case "f", "female"

MsgBox("Female")

Case "m", "male"

MsgBox("Male")

Case Else

MsgBox("Unknown")

End Select

End Sub

Applying a Range of Values for a Case

You can use a range of values for a case. To do this, on the right side of Case, enter the lower value, followed by To, followed by the higher value. Here is an example:

<script runat="server">

Sub Find()

Dim nbr As Integer

nbr = 24

Select Case nbr

Case 0 To 17

Response.Write("Teen")

Case 18 To 55

Response.Write("Adult")

Case Else

Response.Write("Senior")

End Select

End Sub

End Sub

</script>

Validating a Range of Cases

You can use a range of values for a case. To do this, on the right side of a Case, enter the lower value, followed by To, followed by the higher value. Here is an example:

Private Sub cmdFunction_Click()

Dim Age As Integer

Age = 24

Select Case Age

Case 0 To 17

MsgBox("Teen")

Case 18 To 55

MsgBox("Adult")

Case Else

MsgBox("Senior")

End Select

End Sub

Consider the following procedure:

Private Sub cmdFunction_Click()

Dim Number As Integer

Number = 448

Select Case Number

Case -602

MsgBox "-602"

Case 24

MsgBox "24"

Case 0

MsgBox "0"

End Select

End Sub

Obviously, this Select Case statement will work in rare cases only when the expression of a case exactly matches the value sought for. In reality, for this type of scenario, you could validate a range of values. The Visual Basic language provides an alternative. You can check whether the value of the Expression responds to a criterion instead of an exact value. To create it, you use the Is operator with the following formula:

Is Operator Value

You start with the Is keyword. It is followed by one of the Boolean operators we know already: =, <>, <, <=, >, or >=. On the right side of the Boolean operator, type the desired value. Here are examples:

Private Sub cmdFunction_Click()

Dim Number As Integer

Number = -448

Select Case Number

Case Is < 0

MsgBox("The number is negative")

Case Is > 0

MsgBox("The number is positive")

Case Else

MsgBox("0")

End Select

End Sub

Although we used a natural number here, you can use any appropriate logical comparison that can produce a True or a False result. You can also combine it with the other alternatives we saw previously, such as separating the expressions of a case with commas.

Select...Case and Conditional Built-In Functions

To functionaly apply select cases, the Visual Basic language provides a function named Choose that can check a condition and take an action. The Choose() function is presented as follows:

Public Function Choose( _ ByVal Index As Double, _ ByVal ParamArray Choice() As Variant _ ) As Variant

This function takes two required arguments. The first argument is equivalent to the expression of our Select Case formula. The first argument must be a number (a Byte, an Integer, a Long, a Single, or a Double value). In place of the Case sections, for the second argument, provide the equivalent expression-x as a list of values. The values are separated by commas. Here is an example:

Choose(payrollFrequency, "Weekly", "Biweekly", "Semimonthly", "Monthly")

As mentioned already, the values of the second argument are provided as a list. Each member of the list uses an index. The first member of the list, which is the second argument of this function, has an index of 1. The second value of the argument, which would be the third argument of the function, has an index of 2. You can continue adding the values of the second argument as you see fit.

When the Choose() function has been called, it returns a value of type Variant. You can retrieve that value, store it in a variable and use it as you see fit.

The value of the Choose() function can be expressions. Here is an example:

Private Sub cmdCalculate_Click()

Dim incomeTax As Double

Dim hourlySalary As Double, timeWorked As Double

Dim grossSalary As Double, netPay As Double

Dim payrollFrequency As Integer

hourlySalary = CDbl(Nz(TxtHourlySalary))

timeWorked = CDbl(Nz(txtTimeWorked))

grossSalary = hourlySalary * timeWorked

payrollFrequency = CInt(InputBox("Enter a number for the frequency by which " & vbCrLf & _

"the payroll is processed:" & vbCrLf & _

"1 - Weekly" & vbCrLf & _

"2 - Biweekly" & vbCrLf & _

"3 - Semimonthly" & vbCrLf & _

"4 - Monthly", _

"Payroll Frequency", "1"))

If (payrollFrequency < 1) Or (payrollFrequency > 4) Then payrollFrequency = 1

incomeTax = Choose(payrollFrequency, 99.1 + (grossSalary * 0.25), 35.5 + (grossSalary * 0.15), 38.4 + (grossSalary * 0.15), incomeTax = 76.8 + (grossSalary * 0.15))

netPay = grossSalary - incomeTax

TxtHourlySalary = TxtHourlySalary

txtTimeWorked = txtTimeWorked

txtGrossSalary = FormatNumber(grossSalary)

txtPayrollFrequency = Choose(payrollFrequency, "Weekly", "Biweekly", "Semimonthly", "Monthly")

txtIncomeTax = FormatNumber(incomeTax)

txtNetPay = FormatNumber(netPay)

End Sub

Select...Case-Related Functions: Switch()

As another alternative to an If...Then condition, the Visual Basic language provides a function named Switch. Its syntax is:

Public Function Switch( _

ByVal ParamArray VarExpr() As Variant _

) As Variant

This function takes one required argument. To use it in an If...Then scenario, pass the argument as follows:

Switch(ConditionToCheck, Statement)

In the ConditionToCheck placeholder, pass a Boolean expression that can be evaluated to True or False. If that condition is true, the second argument would be executed.

When the Switch() function has been called, it produces a value of type Variant (such as a string) that you can use as you see fit. For example, you can store it in a variable. Here is an example:

Private Sub cmdFunction_Click()

Dim Status As Integer, EmploymentStatus As String

Status = 1

EmploymentStatus = "Unknown"

EmploymentStatus = Switch(Status = 1, "Full Time")

MsgBox "Employment Status: " & EmploymentStatus

End Sub

In this example, we used a number as argument. You can also use another type of value, such as an enumeration. When using the Switch function, if you call it with a value that is not checked by the first argument, the function produces an error. To apply this function to an If...Then...Else scenario, you can call it using the following formula:

Switch(Condition1ToCheck, Statement1, Condition2ToCheck, Statement2)

In the Condition1ToCheck placeholder, pass a Boolean expression that can be evaluated to True or False. If that condition is true, the second argument would be executed. To provide an alternative to the first condition, pass another condition as Condition2ToCheck. If the Condition2ToCheck is true, then Statement2 would be executed. Once gain, remember that you can get the value returned by the Switch() function and use it.

Nesting a Conditional Statement in a Case Selection

A conditional statement can be created in the body of a Case statement, which is referred to as nesting. In fact, a Select statement can be created in a Case or a Case Else section.

A conditional statement can be created or nested in a case of a conditional selection.

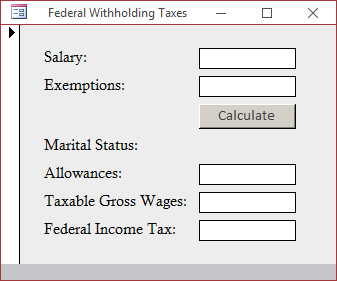

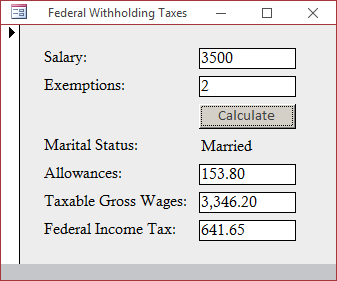

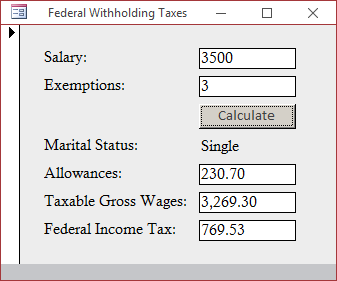

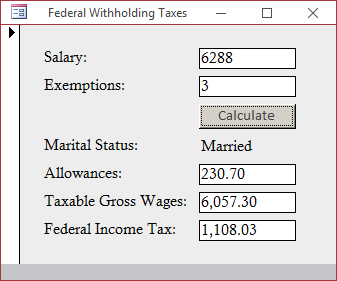

Learning: Nesting a Conditional Statement in a Case Selection

Learning: Nesting a Conditional Statement in a Case Selection

Private Sub cmdCalculate_Click()

Dim salary As Double

Dim exemptions As Double

Dim allowanceRate As Double

Dim maritalStatus As Integer

Dim withheldAmount As Double

Dim taxableGrossWages As Double

Dim withholdingAllowances As Double

allowanceRate = 76.9

salary = CDbl(txtSalary)

exemptions = CDbl(txtExemptions)

withholdingAllowances = allowanceRate * exemptions

taxableGrossWages = salary - withholdingAllowances

maritalStatus = CInt(InputBox("Enter the employee's marital status:" & vbCrLf & _

"1 for Single" & vbCrLf & _

"2 for Married" & vbCrLf & _

"3 for Separated" & vbCrLf & _

"4 for Widow", _

"Marital Status", "1"))

Select Case maritalStatus

Case 1

If taxableGrossWages <= 44# Then

withheldAmount = 0#

ElseIf (taxableGrossWages > 44#) And (taxableGrossWages <= 222#) Then

withheldAmount = (taxableGrossWages - 44#) * 10# / 100#

ElseIf (taxableGrossWages > 222#) And (taxableGrossWages <= 764#) Then

withheldAmount = 17.8 + ((taxableGrossWages - 222#) * 15# / 100#)

ElseIf (taxableGrossWages > 764#) And (taxableGrossWages <= 1789#) Then

withheldAmount = 99.1 + ((taxableGrossWages - 764#) * 25# / 100#)

ElseIf (taxableGrossWages > 1789#) And (taxableGrossWages <= 3685#) Then

withheldAmount = 355.05 + ((taxableGrossWages - 1789#) * 28# / 100#)

ElseIf (taxableGrossWages > 3685#) And (taxableGrossWages <= 7958#) Then

withheldAmount = 886.23 + ((taxableGrossWages - 3685#) * 33# / 100#)

ElseIf (taxableGrossWages > 7958#) And (taxableGrossWages <= 7990#) Then

withheldAmount = 2296.32 + ((taxableGrossWages - 7958#) * 35# / 100#)

Else

withheldAmount = 2307.52 + ((taxableGrossWages - 7990#) * 39.6 / 100#)

End If

Case 2

If taxableGrossWages <= 165# Then

withheldAmount = 0#

ElseIf (taxableGrossWages > 165#) And (taxableGrossWages <= 520#) Then

withheldAmount = (taxableGrossWages - 165#) * 10# / 100#

ElseIf (taxableGrossWages > 520#) And (taxableGrossWages <= 1606#) Then

withheldAmount = 35.5 + ((taxableGrossWages - 520#) * 15# / 100#)

ElseIf (taxableGrossWages > 1606#) And (taxableGrossWages <= 3073#) Then

withheldAmount = 198.4 + ((taxableGrossWages - 1606#) * 25# / 100#)

ElseIf (taxableGrossWages > 3073#) And (taxableGrossWages <= 4597#) Then

withheldAmount = 565.15 + ((taxableGrossWages - 3073#) * 28# / 100#)

ElseIf (taxableGrossWages > 4597#) And (taxableGrossWages <= 8079#) Then

withheldAmount = 991.87 + ((taxableGrossWages - 4597#) * 33# / 100#)

ElseIf (taxableGrossWages > 8079#) And (taxableGrossWages <= 9105#) Then

withheldAmount = 2140.93 + ((taxableGrossWages - 8079#) * 35# / 100#)

Else

withheldAmount = 2500.03 + ((taxableGrossWages - 9105#) * 39.6 / 100#)

End If

Case Else

withheldAmount = 0#

End Select

txtMaritalStatus = Choose(maritalStatus, "Single", "Married", "Separated", "Widow")

txtAllowances = FormatNumber(withholdingAllowances)

txtTaxableGrossWages = FormatNumber(taxableGrossWages)

txtFederalIncomeTax = FormatNumber(withheldAmount)

End Sub

Public Enum MaritalStatus

StatusSingle = 1

StatusMarried = 2

StatusSeparated = 3

StatusWidow = 4

End Enum

Public Enum PayrollFrequency

Weekly = 1

Biweekly = 2

End Enum

Private Sub cmdCalculate_Click()

Dim salary As Double

Dim exemptions As Double

Dim allowanceRate As Double

Dim withheldAmount As Double

Dim taxableGrossWages As Double

Dim marriedStatus As MaritalStatus

Dim withholdingAllowances As Double

Dim payFrequency As PayrollFrequency

allowanceRate = 76.9

salary = CDbl(txtSalary)

exemptions = CDbl(txtExemptions)

withholdingAllowances = allowanceRate * exemptions

taxableGrossWages = salary - withholdingAllowances

marriedStatus = CInt(InputBox("Enter the employee's marital status:" & vbCrLf & _

"1 for Single" & vbCrLf & _

"2 for Married" & vbCrLf & _

"3 for Separated" & vbCrLf & _

"4 for Widow", _

"Marital Status", "1"))

payFrequency = CInt(InputBox("Enter the frequency by which the payroll is processed:" & vbCrLf & _

"1 - Weekly" & vbCrLf & _

"2 - Biweekly", _

"Payroll Frequency", "1"))

Select Case payFrequency

Case PayrollFrequency.Weekly

Select Case marriedStatus

Case MaritalStatus.StatusSingle

If taxableGrossWages <= 44# Then

withheldAmount = 0#

ElseIf (taxableGrossWages > 44#) And (taxableGrossWages <= 222#) Then

withheldAmount = (taxableGrossWages - 44#) * 10# / 100#

ElseIf (taxableGrossWages > 222#) And (taxableGrossWages <= 764#) Then

withheldAmount = 17.8 + ((taxableGrossWages - 222#) * 15# / 100#)

ElseIf (taxableGrossWages > 764#) And (taxableGrossWages <= 1789#) Then

withheldAmount = 99.1 + ((taxableGrossWages - 764#) * 25# / 100#)

ElseIf (taxableGrossWages > 1789#) And (taxableGrossWages <= 3685#) Then

withheldAmount = 355.05 + ((taxableGrossWages - 1789#) * 28# / 100#)

ElseIf (taxableGrossWages > 3685#) And (taxableGrossWages <= 7958#) Then

withheldAmount = 886.23 + ((taxableGrossWages - 3685#) * 33# / 100#)

ElseIf (taxableGrossWages > 7958#) And (taxableGrossWages <= 7990#) Then

withheldAmount = 2296.32 + ((taxableGrossWages - 7958#) * 35# / 100#)

Else

withheldAmount = 2307.52 + ((taxableGrossWages - 7990#) * 39.6 / 100#)

End If

Case MaritalStatus.StatusMarried

If taxableGrossWages <= 165# Then

withheldAmount = 0#

ElseIf (taxableGrossWages > 165#) And (taxableGrossWages <= 520#) Then

withheldAmount = (taxableGrossWages - 165#) * 10# / 100#

ElseIf (taxableGrossWages > 520#) And (taxableGrossWages <= 1606#) Then

withheldAmount = 35.5 + ((taxableGrossWages - 520#) * 15# / 100#)

ElseIf (taxableGrossWages > 1606#) And (taxableGrossWages <= 3073#) Then

withheldAmount = 198.4 + ((taxableGrossWages - 1606#) * 25# / 100#)

ElseIf (taxableGrossWages > 3073#) And (taxableGrossWages <= 4597#) Then

withheldAmount = 565.15 + ((taxableGrossWages - 3073#) * 28# / 100#)

ElseIf (taxableGrossWages > 4597#) And (taxableGrossWages <= 8079#) Then

withheldAmount = 991.87 + ((taxableGrossWages - 4597#) * 33# / 100#)

ElseIf (taxableGrossWages > 8079#) And (taxableGrossWages <= 9105#) Then

withheldAmount = 2140.93 + ((taxableGrossWages - 8079#) * 35# / 100#)

Else

withheldAmount = 2500.03 + ((taxableGrossWages - 9105#) * 39.6 / 100#)

End If

End Select

Case PayrollFrequency.Biweekly

Select Case marriedStatus

Case MaritalStatus.StatusSingle

If taxableGrossWages <= 88# Then

withheldAmount = 0#

ElseIf (taxableGrossWages > 88#) And (taxableGrossWages <= 443#) Then

withheldAmount = (taxableGrossWages - 88#) * 10# / 100#

ElseIf (taxableGrossWages > 443#) And (taxableGrossWages <= 1529#) Then

withheldAmount = 35.5 + ((taxableGrossWages - 443#) * 15# / 100#)

ElseIf (taxableGrossWages > 1529#) And (taxableGrossWages <= 3579#) Then

withheldAmount = 198.4 + ((taxableGrossWages - 1529#) * 25# / 100#)

ElseIf (taxableGrossWages > 3579#) And (taxableGrossWages <= 7369#) Then

withheldAmount = 710.9 + ((taxableGrossWages - 3579#) * 28# / 100#)

ElseIf (taxableGrossWages > 7369#) And (taxableGrossWages <= 15915#) Then

withheldAmount = 1772.1 + ((taxableGrossWages - 7369#) * 33# / 100#)

ElseIf (taxableGrossWages > 15915#) And (taxableGrossWages <= 15981#) Then

withheldAmount = 4592.28 + ((taxableGrossWages - 15915#) * 35# / 100#)

Else

withheldAmount = 4615.38 + ((taxableGrossWages - 15981#) * 39.6 / 100#)

End If

Case MaritalStatus.StatusMarried

If taxableGrossWages <= 331# Then

withheldAmount = 0#

ElseIf (taxableGrossWages > 331#) And (taxableGrossWages <= 1040#) Then

withheldAmount = (taxableGrossWages - 331#) * 10# / 100#

ElseIf (taxableGrossWages > 1040#) And (taxableGrossWages <= 3212#) Then

withheldAmount = 70.9 + ((taxableGrossWages - 1040#) * 15# / 100#)

ElseIf (taxableGrossWages > 3212#) And (taxableGrossWages <= 6146#) Then

withheldAmount = 396.7 + ((taxableGrossWages - 3212#) * 25# / 100#)

ElseIf (taxableGrossWages > 6146#) And (taxableGrossWages <= 9194#) Then

withheldAmount = 1130.2 + ((taxableGrossWages - 6146#) * 28# / 100#)

ElseIf (taxableGrossWages > 9194#) And (taxableGrossWages <= 16158#) Then

withheldAmount = 1983.64 + ((taxableGrossWages - 9194#) * 33# / 100#)

ElseIf (taxableGrossWages > 16158#) And (taxableGrossWages <= 18210#) Then

withheldAmount = 4281.76 + ((taxableGrossWages - 16158#) * 35# / 100#)

Else

withheldAmount = 4999.96 + ((taxableGrossWages - 18210#) * 39.6 / 100#)

End If

End Select

End Select

txtMaritalStatus = Choose(marriedStatus, "Single", "Married", "Separated", "Widow")

txtAllowances = FormatNumber(withholdingAllowances)

txtTaxableGrossWages = FormatNumber(taxableGrossWages)

txtFederalIncomeTax = FormatNumber(withheldAmount)

End Sub

|

|

||

| Previous | Copyright © 2002-2022, FunctionX, Inc. | Next |

|

|

||